Lending Club, among other players in the industry such as Prosper, is one of the great success stories in the peer-to-peer revolution, or the “share economy”. The idea is simple enough, the internet is ideal for cutting out middlemen, so why not banks?

In the idealized (and fictitious) scenario, a bank is an institution that takes and safeguards deposits from people in exchange for an interest rate, say 2%, and then uses those deposits to make loans to people and businesses that need them at a higher interest, say for example 6%.

The Bank is thus simply an intermediary that facilitates a market in which some people have money they wish to save, and others need loans to invest or purchase goods and services with. Lenders and borrowers. The margin between the two rates, 6 and 2 percent respectively, is the gross profit of the bank, in this case 4%. And of course, out of that 4%, the bank presumably has to pay its many expenses such as rent, insurance, marketing, staff salaries (a really high-tech secure vault like in the movies) and the like. And finally, like in any business, if there is some profit leftover after all these expenses, the bank is an ongoing profitable concern, providing a valuable service to the community.

Under this scenario, peer to peer lending makes perfect sense and should become massive if not the norm. Technology and the web, can connect depositors and borrowers directly, and we can save on the massive expenses of running banks, from staffed branches to bloated legal departments and even bank robberies. The dynamic would be easy to see, depositors could get, say 4% instead of 2% in our above example, and borrowers could pay that same 4% rather than the current 6% (small fee for the connecting website/technology aside). A win win.

And this is essentially the Lending Club model. The rest are details such as how to diversify each individual’s deposits among many borrowers to minimize risk to the individual investor. And sure it has been very successful, at around $15 billion USD in loans disbursed since its inception in 2016. However, the net value of outstanding loans held by US FDIC insured institutions alone is currently around $8.7 trillion! And the value of those that are personal loans is around $1.5 trillion.

On the other hand, Lending Club has a total outstanding value of current loans of between 6 to 7 billion dollars. That would be .07% of all loan value and .43% of personal loan value currently held by FDIC insured institutions (and many lenders from credit card issuers to mortgage lenders are not FDIC insured and aren’t even included in these totals, lending club itself being a good example of a non FDIC insured lender). Adding to these totals other peer to peer lending networks such as Prosper would not make much difference in these totals.

As an example, services such as Uber and Lyft have completely decimated the Taxi business, and in many US cities, Uber alone has taken over more than 50% market share of total rides. And hold your horses, lest you quip! Other “share” services such as AirBnB are not a good analogy because Hotels are not simply an intermediary of living space, but actual massive owners and operators of living space and auxiliary services. While Taxis did in fact own cars, so did many of the rest of us (without having to also live in them such as homes and apartments) and they are not as big or unique asset in any given area (unlike living space). But in any event, using our examples while Hotels actually own and add much value to customers needing hospitality, and taxis less so, both industries have been severely hit by the peer-to-peer innovations, understandably taxis much more so than Hotels.

But Banks, which supposedly literally are only an intermediary of completely fungible money (no one dollar is better or worse than any other dollar, unlike apartments, views, cars and limousines), and not the lenders themselves, have hardly been hit at all.

Sure, a big part of the reason are government regulations and laws, the butchers of innovation. Even today, Lending Club is available to borrowers in 49 states, and to investors in about 45 states (and this has been achieved only recently). Prosper is available in even fewer states, and each company has had to tackle regulators in each individual state in a very frustrating and complex process. However, most innovations will face government hurdles, the previous examples of airbnb and uber are under total attack by local regulators and governments.

The Advantage Banks Have

The main reason for the lack of “explosiveness” in the peer to peer lending world is in fact due to government intervention, but of a different a special kind. The reality is that pre-existing competitors in the banking system are NOT at all what many people think them to be and was described above.

Rather than being an intermediary of money, simply facilitating the market between savers and borrowers, banks are in fact endowed with special magical powers by the government (in the current fractional reserve system) to simply conjure up money out of thin air!

To fully explore this fascinating topic would require an article (and in fact books) of its own, but sufficed to say, that with the current federal reserve system that serves as a lender of last resort, buys and sells Treasury securities to keep a usually low target interest rate, legal tender laws and FDIC insurance, banks do not need to seek out deposits in order to make loans but rather require only creditworthy borrowers to lend to. This article on MMT and this other one income tax touch upon this subject.

Individuals walk into a bank and get their loan application accepted or denied based on its own merits (credit score, verifiable income, business plan etc), but its unheard of to hear the banker say

Yes, we like your loan and want to fund it, but please come back tomorrow… we are out just now but think we are getting some more depositors this afternoon.

Doesn’t happen. The Bank always seems to have any amount of money to lend, it just needs people to lend it to. It cannot simply create money for its own profit or coffers directly, but it can make up money in exchange for the signature of any credit-worthy borrower. When the loan application is accepted, a few keystrokes adds the new money into the borrower’s account.

Branches, salaries and all the extra expenses a bank carries that a Lending Club does not, are more than compensated for by this incredible magical financial power. Lending Club has to literally attract every penny it disburses as loans from willing investors who have to forego real cash available to them in order to invest it.

The most important manifestation of this magical power granted by governments to banks is that none of the depositors ever know they are lending, or even feel that they have invested, taken on risk, or foregone the use of their money for any period of time. For example, your standard checking account (and even most savings account) enables depositors free use of their money at any time. Be it an ATM card, a checkbook or just withdrawing cash at a local branch, depositors feel that all of their money is available at any time. When you check your balance at the nearest ATM, it does not read “sorry, you’re available balance is currently 0 because we loaned your money to Johnny, but don’t worry he is credit worthy and most likely will pay back”. On the contrary, both your bank account balance, and Johnny’s which just went up by the loan amount, state that 100% of the money is there and available. Responsibility and risk aversion of the depositor/investor is reduced to zero.

And as we know from the old stories of “runs on the bank”, if all of us or even a significant part of us tried to withdraw this supposedly available cash, it wouldn’t be there. Except that under the current federal reserve system and FDIC insurance, it really is because the government will simply print enough money to satisfy the customers. As long as the bank loaned to creditworthy customers, it can get cash at the Fed’s discount window if it needed to (although more often it would simply ask other banks). So the bank gets to create money that doesn’t exist, and if it ever needs to exist, then the government will end up printing it, physically or electronically.

Now whether the depositors have their money in standard “on demand” accounts or invested in longer term CD’s (Certificates of Deposit), it hardly matters. Depositors invest in longer term savings accounts or CDs in order to get some interest from the bank, however small. In theory, the depositor does not have access to the money into the CD until the date of maturity. In reality however, individuals and businesses can withdraw their money held in CDs freely, by paying a relatively small fee. For example, on a 5 year CD, an early withdrawal fee might mean foregoing 6 months of interest (which can mean about .5% of the principal). Furthermore, CDs are typically held for 3 months up to a year (with the longest ones being issued for 5 years) while loans tend to be held from 3 to 5 years for personal loans and typically up to 30 years for mortgages.

It goes without saying, that Lending Club has to match up the investor and borrower time frames.

If all of this wasn’t enough, money deposited in banking institutions, be it in checking accounts, savings accounts, CDs or other instruments, is virtually risk free (carrying only the inherent risk of owning dollars) as it tends to be privately and FDIC insured, plus otherwise de facto insured by the government that cannot let the banking system or major banks fail (as we have seen all too recently and all too often). Money in vested in Lending Club certainly gives off a different feeling, and risk is an all too real part of the equation.

Big Liquidity Difference

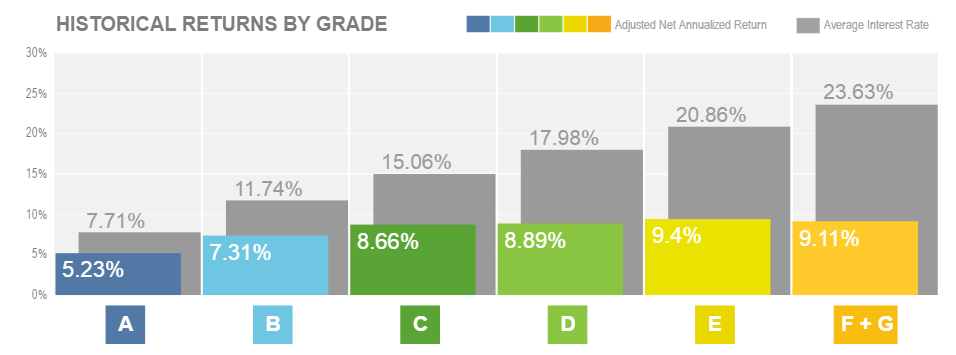

All of this adds up to a giant liquidity difference between money deposited in the banking system and money invested in Lending Club. The effect of that is of course that the interest rate, or better said the effective return on investment (net return after borrower defaults) that Lending Club offers has to be massively better than what banks offer depositors. As an example, current effective returns on Lending Club are between 5% to 9%, while 1 year CD rates are at around 1.12%. Taking a midpoint, that means Lending Club offers investors/depositors a 625% greater return than a bank.

And while the return for potential investors is so much greater, the discount for potential borrowers is very small if it exists at all. Certainly, many Lending Club borrowers get a significant discount on their current credit card balances by consolidating their debt with a Lending Club loan, but they would get a very similar discount from a debt consolidator or bank. So while Lending Club offers investors relatively high rates in order to attract a substantial amount of money, where it’s competitors get to simply create it out of thin air (and thus offer 1% CD rates), it offers the smallest of discounts to the borrower (in order to achieve the high returns needed to attract investment).

What is missing are Borrowers

Positioned the way it is, the bottleneck for Lending Club is the number of borrowers available, or at least the number of credit worthy borrowers willing to pay the required interest rate. Much like the banks, who need a credit worthy signature to conjure up money into existence, Lending Club is also dependent on them. With the relatively high interest rates, there is currently plenty of money waiting to invest into Lending Club, but seeing no earth-shaking difference in terms or interest rates, quality borrowers are not lining up by the droves.

Investors are happy to make those healthy returns, as long as they are to credit worthy borrowers; no one wants to risk their money by lending to “sub prime” borrowers for a 9% interest rate. At the lower end of the credit spectrum, interest rates are at an ever diminishing proposition. Lower grade loans in Lending Club pay up to 26% interest or so, but default at such a high frequency that the net return again is around 8%. And creditworthy borrowers are not desperate for money, and so are only willing to take a loan with good terms. They can always get one from the bank that can make up money without attracting investors.

The result being that grade A loans in Lending Club pay as little as around 5% interest rate. This is pretty much as low as they can go while still earn a profit and attract investors who are willing to forego all the above mentioned conveniences of the banking system including FDIC insurance. Start going below that, and finding a 1.5% CD or even a mutual fun sound better. Let’s not forget the Lending Club returns, to make matters worse, are taxable as regular income as opposed to the lowered taxed capital gains.

Lending Club Reaching out to Banks

The proof is in the pudding. Recently Lending Club announced a deal with 2 small banks, Titan Bank and Congressional Bank. The deal allows the Banks to use the lending club platform to offer small consumer loans that they otherwise could not profitably originate (the fixed costs and overhead of a bank). The announcement says that the banks may or may not fund the loans as well, the important thing clearly is that Lending Club needs more borrowers and that is why it’s interested in the partnership. The banks for their part, simply are able to make loans to consumers that previously they were turning away.

In order to really expand, the peer-to-peer lending world has to offer the ultimate driving force and client, the borrower, a better deal. Either by giving loans to people that don’t qualify for them elsewhere, by giving people who do a much lower interest rate, or both.

To do this it needs to attract vast amounts of money from investors willing to receive a much smaller return. While it remains to be seen whether the fractional reserve system can be competed with, there are certainly a great number of benefits from the peer to peer model, namely in efficiency, cost savings and data driven decision opportunities. One key factor missing in order to attract these moneys is the lack of liquidity of lending club investments.

While Lending Club’s primary market includes automation and is a relatively nice platform, the secondary market in partnership with Folio FN is a terribly tedious platform. Trading any significant of money is incredibly difficult and time consuming. Most importantly, the liquidity available in the market is tiny and most often notes cannot be sold without large losses, if at all.

Service that provides Liquidity

Investors would surely be willing to Lend to Borrowers on platforms like Lending Club if they felt their investments were more liquid. Today, one service which is excellent at providing a remedy for this problem is www.liquidatelendingclub.com

Not meant to use as an alternative trading platform, anyone who needs to sell or liquidate any significant part of their Lending Club account , or in fact liquidate the entire account, will find their service very useful. Rather than attempt the very complex, tedious and expensive task of trying to sell each note on the secondary market, www.liquidatelending.com will quickly give you an exact quote for the sale of all your notes (or whichever notes you want to sell) and automatically execute that sale if you agree. The process is secure, safe and painless. Anyone who needs to pull money out of lending club investments will find this tool saves them a great deal of money and headache. The transactions are done within the Lending Club platform, and the money always remains in the user’s account.

In a capitalist system, peer to peer lending would certainly be a huge improvement over traditional banking if not its death-blow, but current government regulation allows some with a licence to create money out of thin air while guaranteeing their liabilities, while others have to invest real hard earned cash in order to lend it to their fellows. Though a topic for another discussion, the differences of these two approaches in macroeconomic terms are massive, and it will be interesting to see how Lending Club and others in the space continue to innovate to fight the fight and play the game.

Facebook Comments

WordPress Comments

Disqus Comments