Today was interesting indeed. The market is an interesting place for sure, and on its best days not for the faint of heart. Yet today, a few of us witnessed and/or weathered a real storm. Unfortunately, few if any of us, saw any gains from the cataclysmic movement of DGAZF today, because few if any folks had any shares. The gain was among a small cabal that had the market cornered. Perhaps not altogether legally either.

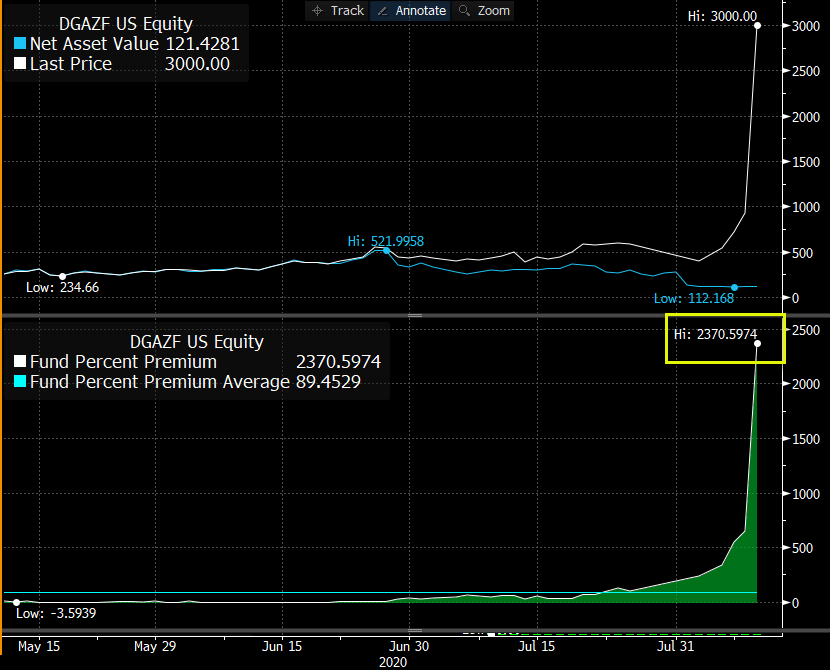

In short, DGAZF had a NAV, or more accurately an indicative value of about $110-$130 dollars per share today, and traded at over $25,000 a share. Meaning it easily was trading at 200 times its value.

There is a strong message in this piece for Credit Suisse, who ultimately promised investors in their ETN, whether holders of long or short positions, that, that DGAZF will closely track the Index it ought to track.

DGAZF (VelocityShares 3x Inverse Natural Gas ETN) originally DGAZ before recently delisting, is an ETN which gains investors exposure in Natural Gas, more accurately 3 times its inverse (specifically 3x the Inverse of the S&P GSCI Natural Gas Index ER).

Like many leveraged ETFs, it may not be a product that is ideal for holding long term since it aims to track the daily performance, and not the long term performance of the index. There is a lot of conflicting opinions on that issue (maybe we tackle it on a different day) including issues on contagion and decay (which may mean leveraged ETFs lose value over the long term), but these are not relevant to our discussion here. First, leveraged products are commonly held for periods much longer than a day, often years, and this issue is relevant for optimized tracking and the losing of a certain percent (due to rollover, resetting and the like) over the theoretical trend per month. It has no relevance here.

First the issues of decay, contagion and other effects that reportedly make such products certain to lose all their value over time are not that simple. If they were, a sure-money bet would be simply to short any or all such leveraged ETFs and in the long term make money as they all go to zero. Such an investment is trickier than one may think. Leveraged ETFs can go for long periods of time gaining value, despite the cited effects, which can work for you or against you, in both a long or short position depending on many factors.

Secondly, DGAZF is not an ETF but an ETN. As such it ought not to be affected by contagion directly, as the security does not represent a share of actual assets that are purchased and sold (and thus for example lose value in periods of high contagion due to future rollovers), but actually are really bonds backed by the issuer, in this case the formidable Credit Suisse, which directly track a specific index. The upside of ETNs includes their ability to MORE CLOSELY track their underlying index and more favorable tax treatment. A commonly cited downside on the other hand, is that they include credit risk in addition to the inherent index risk (ie the credit worthiness of Credit Suisse itself).

In any event, none of these tracking errors, even those inherent in ETFs which actively rollover futures, are relevant to the scale of the issue we encountered today, where we are talking of a change of hundreds of times the intrinsic market value over a couple of days; most of it within today’s trading day alone. Especially when no such comparable change or dislocation exists in the prices of the index or natural gas, neither in the spot market nor any of the commodity’s futures. What we saw today was completely devoid of any inherent valuation, and a complete disassociation from the prices of any index or even related commodities.

Since an ETN is literally a bond that points to a specific indicative value, today’s market was basically showing that $125 dollars or so (the approximate true value of a DGAZ share today) was trading for up to $25,000 dollars. That simply does not happen and would not happen, if market participants are given a chance to participate.

So whats the problem with a meteoric rise? Aren’t shareholders happy?

The problem is inherently interconnected to the reason why this meteoric rise happened, and why you do not have a great many happy shareholders but rather a great many distraught investors at the point of being completely wiped out if not already so.

An ETN’s job is to track an underlying index (or some correlation to it). It is not to go up nor go down, but simply to track it. A good gold ETN tracks the price of gold. You can bet on it, and you may be right or wrong, in the direction that gold prices take, but the ETN should track that value. Most players in the stock market are “big boys”, and they can take a loss when they were wrong as good as they can take a profit when they were right.

Today’s events look like a cornered market, if not a manipulated market.

DGAZF dislocated from its fair value of slightly above $100 dollars a share due to the perfect storm of 3 major factors. I knew of two of them, but was surprised to learn of the third only today.

DGAZF was recently delisted (and so traded in OTC markets) and promises the inverse market of natural gas prices. As the government ordered lockdowns around the world end, oil prices and natural gas prices have been recovering. The “right” move in these past weeks and months was to bet against DGAZF… in essence to short it. As the world does not end due to covid19 as pundits assured us, and human activity and liberty are somewhat restored to previous levels, the prices for energy were to stabilize… and yes go up.

This was obvious to quite a few retail investors who thus kept some short positions in DGAZF. The fact that a stock is delisted should normally only help it to drop in price and not soar in price, and so the short position can seem to be of reasonable risk. Especially if countered by other positions, for example UGAZF (the inverse of DGAZF, which has behaved normally thus far).

Furthermore, while shorts infamously have an infinite downside, (stocks can only drop to 0 at the most, but go up infinitely), one must remember DGAZF itself is a short. It is the inverse of natural gas prices, and natural gas prices themselves could only go to 0 as well (though recently we have seen long oil positions lose more than 100% as they went super negative as well! So yes lock-downs create havoc in all sorts of new and unpredictable ways), so “shorting a short” is not the same as “shorting a long”. Shorting a short is inherently a more conservative proposition than shorting a long.

So this leaves us with factor number 1, a significant short float among the public and retail investors. People that ironically, were on the “right” side of the bet. Natural gas have not collapsed as lockdowns end, but on the contrary, risen along with oil prices.

Factor number 2 is that the reverse is not the case. The public does not hold these shares. Like I said, holding on even medium term to an inverse of natural gas prices was not prudent and so the public would not hold long positions of a delisted 3x Inverse of a natural gas price index. The public long float was very small if it existed at all. Shares held by the public tend to limit the extend of short squeezes and regulate prices in general as they are a ready supply of shares to meet any demand, and they compete against each other by lowering their offers or “Asks”.

Factor number 3 (unknown to me until today) is that Credit Suisse had announced that it would no longer issue shares of the DGAZF ETN. These are the creations by which arbitrageurs in the marketplace help keep the price on track. They are part of the very mechanism of how an ETN works. In essence, Credit Suisse, had quietly announced, that it’s ETN was going to stop working. It would not wind down and liquidate, as any ETF and/or ETN can do at any time, rather it would continue to trade in OTC markets, but simply no longer work. And I bet only a very few would know that. Add to this number 3, another sub-factor, being that OTC stocks cannot typically be shorted by retail investors in accounts in the major brokerages. So no new shares, and no one can short (ie sell without having the shares which is usually IS possible). There is simply no supply of “Asks” to satisfy the demand of those closing their short positions, regardless of the absurdity of the price.

These 3 factors, to the keen eyes of those with the means of accumulating shares must have seemed like a prey too tempting not to corner and pounce on. If you quietly amass and accumulate shares over the last several weeks, especially if you can get some directly from your pals at large institutions or even better Credit Suisse itself (Mark Bard, responding to my feeling market had been cornered on twitter reported that Credit Suisse’s holdings have recently dropped in half or 400 thousand shares!), then the market is yours for the taking.

@ZimermanErik @CreditSuisse had 800k shares – down to 431k per 8/12 13f. Where did they go? Not to the float. Largest shareholders (old 13F) other than CS … Wolverine Trading, Jane Street, GMT Capital, Susquehanna and Citadel (new data next week or two). @JSeyff

— Mark Bard (@markbard) August 12, 2020

The volume is so thin, and the asks so few (since no one in the public had these shares) that when you are ready to press the trigger, it would take relatively meager resources to spike the price up. A sizable trader can eat up the asks and drive the price to absurd prices. They are not “real” market prices mind you, not the price people would really buy and sell the security, there just basically is no market, and a few trades by the few with shares set the price. At this point, the snowball is started and takes on a life of its own. Speculators join in sure, but mostly you have a short squeeze with no supply to fill it. The public which holds no shares but only short positions (made possible by borrowed shares from the same institutions which to add insult to injury have lent these out at interest of course) panic-stricken starts to try to cover them. Others do not want to but are liquidated automatically by their brokers. It is a “crash” in reverse where panic, rather than euphoria, is soaring a share to higher and higher prices… a share trading in the many thousands of dollars who still only represents a bit over a hundred dollars, likely to represent even less in the near future, even while everyone knows it.

The soaring endless crash was fueled by panic, but in the upwards direction, which indeed unlike the downward crash has no limit (at zero). Of course those few that now have the market cornered, oblige the panicked traders looking to close their positions by releasing a few shares at at time and continuously raising the Ask higher and higher.

How ETNs Track Prices

Under normal circumstances, with Credit Suisse doing its job, as it agreed to upon the issuance of the ETN in writing, this could not happen. Again do the aforementioned creations and redemptions. Redemptions are trading shares of the ETN for money, and creations are purchasing new shares issues by the issuer, in exchange fro money. This is the very mechanism by which ETNs track underlying prices and do their job.

To slightly simplify and illustrate the point, an ETN issuer simply announces that it will redeem or issue shares for x price (not necessarily the same price but close). So for example, if demand has brought an ETN with a $125 intrinsic value to $130, market participants will purchase new shares directly from the issuer at $125 and offer them for sale in the market say at $128 (making a risk-less $3 immediately), and others will follow and market competition will trend the price right down to near the $125 market.

Same thing on the other side. If the price was too low, market participants could purchase the shares, say for $100, and turn around and redeem them to the ETN issuer for $125 and make an easy spread. This arbitrage is the very mechanism by which an ETN tracks the price. If the issuer takes away this function, he has literally and deliberately broken the ETN, without the agreement of the investors in it, and without informing most of them despite their buried announcement which certainly I was not alone in not having seen.

Now, to the folks who cornered the market, the move is clever perhaps nearing on brilliant. Noticing the 3 prerequisites that existed here, amassing shares and then executing the upwards snowball was well done and quite ingenious. But depending on how exactly it happened, it may not have been legal, and more importantly, it is not a true win in a free marketplace. Certainly not an honorable one.

Firstly, even in the most free of markets, Credit Suisse at the least would be subject to (ie common law) lawsuits for neglecting their contractual and fiduciary duties in running their ETN. The ETN is supposed to track an index, it is the purpose of the product and the reputation of Credit Suisse tells investors that it will succeed in doing so in all but the most extreme of circumstances. It will certainly at least TRY to succeed in doing so. Here we had no extreme circumstance, it willfully simply decided to break its product, when it had the much better option, as many have done in the past, to simply liquidate and wind down (or “shutter”) the ETN if it no longer wanted to keep tracking the price, as has been done to many ETFs and ETNs in the past (quite a few recently this lock-down season).

Secondly, depending on the parties involved, there could be outright fraud involved. Natural gas prices did not collapse, those who cornered the market did not make the right bet in the honorable way, but knew about and depend on outside-of-market regulatory limitations to simply transfer money from retail investors to their own account. It is regulations that do not allow for options on OTC shares (so retail investors cannot have calls for example, to protect their short position). It is regulations that require the brokers to liquidate margin accounts, regardless of how temporary, thinly traded, or absurd a “mark-to-market” price be. It is regulations that do not allow new traders and market participants to come in short sell DGAZF to increase downward pressure on the stock!

Who in the world with the means would not have sold DGAZF short today for 15, 20 or 25 thousand dollars?! Who would not have shorted a security worth a bit over 100 bucks certain to come down to its market value, be it today, tomorrow or in the next few days… be it because of the end of the unfortunate short squeeze (and the liquidation of the wealth of many unfortunate and wronged individuals) and the end of the artificial demand, or by action of Credit Suisse or regulators? It will come down and quite fast. This is certain. But in the meantime, retail investors who could have a mere one, two, not to mention 10 or more shares shorted could be facing complete loss of their wealth… only to see their short, no longer existing, be profitable hours or days later when normality is restored.

There is a difference in cornering a market by free market forces alone (quite difficult if not impossible) of a good we all want, say gold (or your own new proprietary “iphone”-like contraption)… and offering it a high price to those who want it… and leveraging regulations to force people to buy a 100 dollar share that they don’t want for 25 thousand dollars against their will.

The move was intelligent yes, very interesting, indeed, but not honorable and not proper. Credit Suisse hopefully will do the right thing. Really one of two obvious things. It can either continue to chose to keep DGAZF existing, and fix its broken product, so that it tracks the index it ought to track, or simply liquidate the fund and pay its holders the intrinsic or indicative value.

For any folks that may have bought DGAZF at the insane prices, that would mean a sharp loss, but they engaged in a highly speculative game, knowing that they were buying into a artificial and temporary bubble supported by no real value. They bought once the ETN was obviously broken. Others bought it or sold it with absolutely no indication that Credit Suisse had intentions of breaking it. If Credit Suisse does not take one of these two actions, then one would hope the regulators, who helped create the problem would enforce a similar solution. I would hope CS simply does as it should. It is their product, and they should stand by it. I have always kind of liked them. And I have urged them today in social media, I am sure along with others to take such action and hope they will.

Finally, on a personal note, I would like to say that Interactive Brokers at least for today behaved quite impressively. They did not liquidate any positions due to this issue in any of the accounts that I am involved in, and as far I understand, they did not liquidate any accounts with the position today. They clearly understood that this is a false price with false volume being fed only by a short squeeze and liquidations, and an ETN issuer who refused to enable the normal price tracking mechanism. Normalcy will return and so Interactive Brokers will not be in the red for it, but given the astronomical prices the share reached today, IB must have been facing some real massive losses and dangers.

The question is what of tomorrow? At some point, they will be forced to start liquidation, ironically triggering a further and greater short squeeze. Hopefully (and that is my guess), a solution will be found before that since as I started to write this piece on market close, the security was finally halted. It means eyes are upon it. Interactive Brokers was a mensch today, as I am sure other brokers were as well, let us see if Credit Suisse will step up and be one as well.

Can this happen with other ETNs? Look for the 3 factors! UGAZF for example is lacking the lack of long shares in public hands and the percent public short float (people did not short gas long term in a delisted ETN, they shorted the inverse gas delisted ETN). So it has the potential to act in a similar fashion if a short squeeze is triggered, but if Credit Suisse fixes one, its likely to fix them both. Let me know if you see similar factors in any other ETN, not to partake in such a move as I indicated it is beneath honor, but to let everyone know and add to the discussion and knowledge.

Update August 24 2020

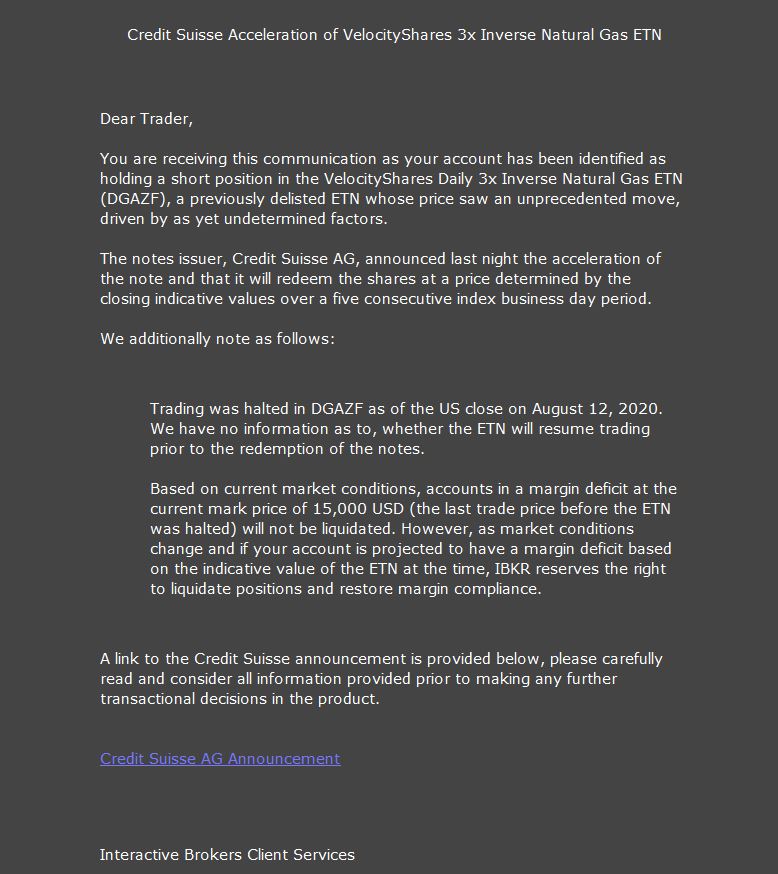

A mere hours after the above post, Credit Suisse did the right thing (though it may have been too late for many private investors) and took one of the two courses of action I suggested. It decided to wind down its ETN rather than allow it to continue to trade and exist, completely broken. It will liquidate according to a 5 day trading average of its index, and NOT according to its recent trading price. This is further testament to much of what was reported in this piece.

The announcement cites that Credit Suisse has every right to “accelerate” the notes (essentially liquidate them and pay off their value to holders), as was argued in above article. What may not be as clearly defined, is their right to keep the security trading, albeit in OTC markets, and no longer issue shares (while still redeeming them) so as to in effect, break their product without much announcement.

Regulators were likely eyeing the situation as the security was halted for trading, even before this announcement. This left many accounts in the uncomfortable situation of still showing an absurd price for the security, frozen at around $15,000 a share or so. For those who were shorting the security, this situation left them in a precarious state, liable to be liquidated by their brokers. For those who had long positions, it may have increased their buying power artificially, and liable to have positions liquidated when this fake value disappears (if it hasn’t already).

As mentioned in social media, some brokers stepped up for their customers, and some did not. While Interactive Brokers walked back it’s firm commitment not to liquidate based on the DGAZ price (and warned customers that it had the right to in a few conflicting notices), it did not do so, and quickly overrode its algorithm to make sure this did not happen automatically. The broker was looking at some seriously frightening red numbers, and assumed that risk for their customers based on an understanding of the risk being temporary and illegitimate (as argued in this piece above), and of what is the right way to behave towards its customers. This is not to be taken for granted, since such a path is fraught with risk in today’s over-regulated and over-litigious world, where often times no good deed goes unpunished.

So while there was still doubt, IB suggested customers take the actions needed to maintain positive margins, since they (IB) had the right to liquidate at any time. This is understandable, and hopefully no clients took losses due to these strong suggestions. Eventually, once the Credit Suisse announcement was clear, IB delivered the following reassuring message to security holders, while still reserving the right to liquidate if conditions warranted. They also did not know if the regulator halt would be lifted.

And while one would think an announcement would pressure the price downwards to its indicative price, there was no guarantee of that based on the current extreme situation, lack of float and ongoing short squeeze. It really would depend on the large shareholders dropping their ask prices to try to try to quickly get rid of as many shares as possible before liquidation at any price significantly higher than the indicative prices. If trading resumed, and prices remained high, IB and other brokers would face days of financial and regulatory risk until the final liquidation. This explains the caveats in their above message (as it turned out, the regulatory halt was never lifted and the share did not trade again).

Since Credit Suisse announced a waiting period which included measuring a 5 day trading day average this left many accounts in an uncomfortable position for quite a while, including over weekends. Interactive Brokers (or some market or agency?) therefore, after a day or two, creatively reverted to the previous closing price which was about $949 per share (also ridiculous, but an order of magnitude less so), and this made accounts “look” better. The security has remained halted since then, and according to Credit Suisse should liquidate tomorrow on Aug 25th, based on the 5-day valuation period (from Aug 14 to Aug 20). This means the average of the closing indicative values of the 5 trading days.

Hopefully, I helped a few folks stay calm and not liquidate their shorts as prices soared at these forced and temporary prices, and perhaps helped a few others not get caught up in the soaring prices (anyone left holding shares bought at these recent prices will lose almost all money invested in them). Perhaps also helped bring a spotlight on this cornered market which represented an incredibly interesting and unusual situation, one which certainly created wrought financial havoc on many a small investor. It was a wild and interesting ride.

Kudos once again to Interactive Brokers for being a “mensch” in this situation. The same goes for Fidelity as I understand. Would love to know which brokers liquidated their account holders based on this DGAZ circus. Feel free to let us know. They should be called out on it, and perhaps there is something to be done for the investors if this comes to light.

Were you forced to cover short positions at thousands of dollars a share of DGAZ? On the other hand, did you see a soaring stock and try to ride it up, only to be left holding it during the regulatory halt and experience the massive percent losses that will be applied tomorrow?

Facebook Comments

WordPress Comments

Disqus Comments